At the last full council meeting Croydon Council Pension Committee dismissed calls for divestment from genocide on grounds of cost and fiduciary duty. Here we answer those objections, and show a way forward.

Investing In Genocide

Croydon council has invested, through its Local Government Pension Scheme fund, over £120 million in arms companies and those complicity in genocide and occupation of Palestine. It has investments in 27 arms companies including Israel’s largest arms manufacturer Elbit Systems which describes itself as the backbone of the Israeli occupation forces in Gaza. Elbit produces 85% of Israel’s killer drone fleet responsible for the targeted slaughter of children in Gaza.

It has also invested over £1.2 million in Lockheed Martin – the world’s largest arms manufacture. Lockheed Martin’s infamous F-35 fighter aircraft, which it describes as the “most lethal fighter jet in the world”, has been extensively used by Israel in its genocide in Gaza – “enabling the dropping of 85,000 tons of bombs [exceeding the amount of explosives used in World War II], most of them unguided, killing and wounding more than 179,411 Palestinians and devastating Gaza” (UNHRC report June 2025).

Lockheed Martin is also one of the largest producers of cluster munitions – outlawed because they cause unacceptable harm to civilians – 93% of casualties are civilians, children making up nearly half (from unexploded bomblets). Over 120 countries, including the UK, are signatories to the Convention on Cluster Munitions which prohibits all use, production, transfer and stockpiling of cluster munitions. Further it prohibits assistance, encouragement or inducement of these activities. The UK has stipulated that investments in cluster munitions production is a form of assistance that is prohibited by the convention (Cluster Munitions Monitor 2024).

Croydon Council Complicit Investments - Key Facts

- Croydon council has known investments of £122 million in companies complicit in genocide and occupation of Palestine.

- Croydon council has directly lent Israel £489,000 via the purchase of Israel state bonds (30 June 2024).

- Croydon council currently invests £22 million in 27 arms companies, these include:

Elbit Systems (£93,886) – Israel’s largest private arms company, it has played a central role in the genocide in Gaza. It produces 85% of Israel’s killer drone fleet responsible for the targeted slaughter of children in Gaza.

Lockheed Martin (£1,206,590) – World’s largest arms manufacturer. Produces F-16, F-35 fighter aircraft, used in war crimes around the world including Gaza and Yemen.

BAE Systems (£504,647) – UK’s biggest arms manufacturer, produces 15% of the F-35 stealth fighter aircraft that has been used in bombing hospitals and schools in Gaza and Yemen.

Airbus (£948,319) – Its Typhoon fighter jets have been implicated in Saudi war crimes in Yemen

Boeing (£1,381,522) – World’s 2nd largest arms company. Its Apache attack helicopters are being used by Israel to commit genocide in Gaza.

Raytheon (£1,780,425) – Produces bombs and missiles that have been documented by Human Rights Watch as being used by Saudi Arabia in Yemen against civilian structures including food warehouses leading to famine. The International Criminal Court in The Hague has been asked to investigate senior arms company executives from BAE Systems, Airbus and Raytheon for responsibility for aiding and abetting Saudi war crimes in Yemen.

Northrop Grumman (£765,364) – Produces nuclear missile systems and stealth bombers, has strong partnerships with the Saudi military.

Croydon residents and pension fund holders are horrified by these revelations that their taxes and pension contributions are being used to fuel genocide. There is a grassroots campaign demanding the council divest from companies complicit in genocide.

At the full council meeting the Head of the Pension Committee, Councillor Callton Young argued two reasons why the council cannot divest, he said “exclusionary policies for individual companies or sectors are not feasible without incurring significant costs and risking breach of our fiduciary duty”.

We will tackle each of these two arguments in turn.

Reason One - Fiduciary Duty

Councils have a fiduciary duty to ensure investments bring healthy returns so that there is enough money in the pension pot to ensure pensioners are looked after. Its undeniable that there is money to be made in genocide, but must we be part of it? Are there no other ways to meet the fiduciary duties of the pension fund? Let’s learn from the recent past.

Past Precedent - Tobacco Divestment

In 2013, Croydon council pension fund had invested millions in the tobacco industry. Despite the community demanding divestment from tobacco, Councillor Dudley Mead, who chaired Croydon council’s pensions committee insisted the council would “absolutely not” be changing policy towards tobacco shares and said it was naive to prioritise “ethical” stock.

He made the same case of fiduciary duty we hear today, saying that: “My duty is to get the best possible return for the investments we make. The reality is that in the last 15 years, tobacco companies have been the best performing investments in the whole of the London Stock Exchange by a considerable distance.” (Local Guardian newspaper 3 Apr 2013).

Yet in the following months change came, and in 2014 the council divested all its stock in the tobacco industry. The pension fund’s fiduciary duty was not compromised, and today it seems like the only sensible decision, with perhaps the only controversy being why did the council ever hold tobacco stock in the first place.

In the following section we will show that the pension fund’s fiduciary duty can be met with ethical investments. We will focus on an example of ethical investment that is particularly pertinent to Croydon – social housing.

Case For Ethical Investment - Homes

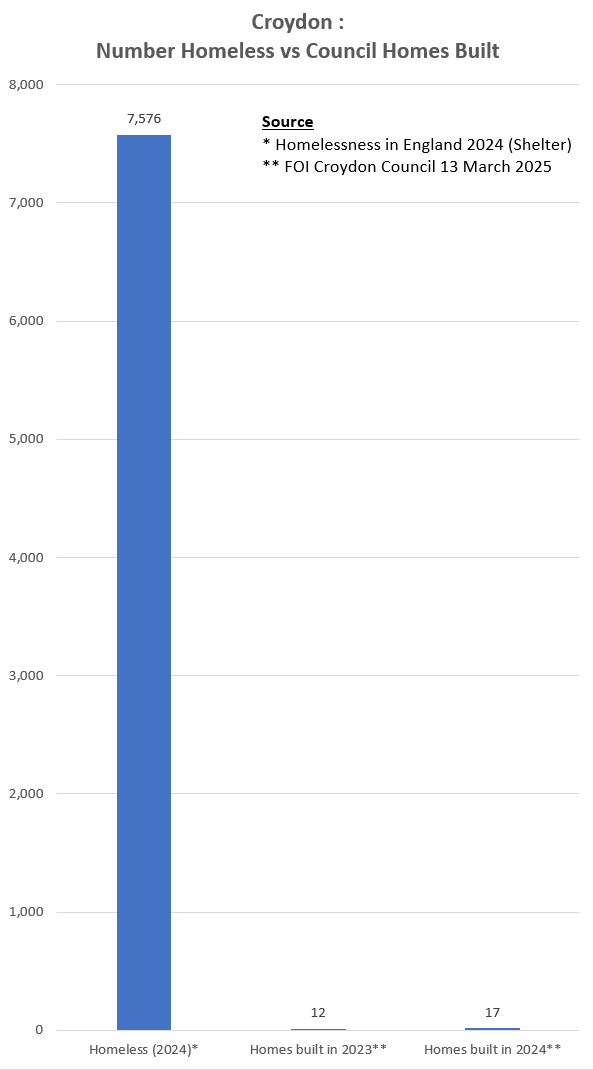

The case for investment in social housing in Croydon is self-evident. The housing charity Shelter has revealed that there are 7,576 homeless people in Croydon (Homelessness in England 2024 Report, Dec 2024).

At Resistance Kitchen we see this first hand with 43.3% of our guests being homeless, of which 15.4% are rough sleepers. Behind these shocking figures are the shattered lives of ordinary people. Recently a homeless lady come to us for help. She had been living with her abusive boyfriend before he attacked her with sharp glass – she showed us a deep cut along the edge of her right hand that she had raised to protect her face. The police prosecuted the boyfriend, but the flat was in his name so she was made homeless. She was not provided with any emergency shelter, so was reduced to sleeping in a tent in Norbury Park for the past 4 weeks, terrified of being attacked as a single woman on her own. 36% of female rough sleepers have been attacked in the last year.

Croydon Council figures published in July 2025 show that for every one person housed in temporary accommodation 3 are turned away due to budget pressure. The council has overspent its housing budget by 73%. This is due to the cost of providing expensive temporary accommodation because there is a shortage of housing. 50 new households every month are housed in temporary accommodation. London’s boroughs are collectively spending around £90m per month – approximately £3m every day, on temporary accommodation because we don’t have enough homes.

Freedom of Information requests show that last year Croydon council only built 17 affordable homes, and the year before that only 12 (FOI Croydon Council 13 March 2025). They claim they have no money to invest in housing, whilst sitting on a pension pot of nearly £2 billion.

Affordable Homes - Great Investment

Apart from the obvious social need of investing in social housing, such investment financially strengthens the council pension fund as it offers:

- Stable, long-term rental income—often supported by government housing benefits—minimizing arrears and vacancies.

- Inflation-linked leases that preserve the real value of assets and align cash flows with rising costs.

- Potential capital appreciation as property values grow, boosting overall fund health.

This strategy not only secures predictable returns to meet future pension liabilities but also delivers affordable housing, aligning financial objectives with social needs.

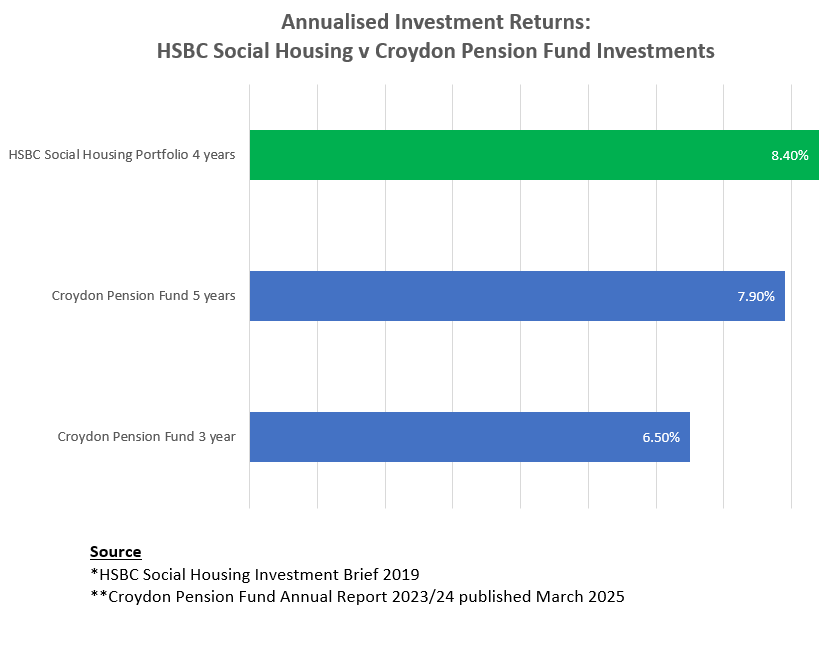

A new 2025 social housing report by New Capital Link states that “social housing investment typically offer returns in the range of 8-10%, providing a competitive yield in the current low- interest- rate environment.”

This is in line with HSBC’s actual figures. In its “Social Housing Investment Brief” published in October 2019. It states that “since inception in 2015 our Social Housing portfolio has delivered a gross annualised return of 8.4%, driven by rental growth of approximately 6.8% per annum and modest capital value uplift underpinned by growing institutional demand and constrained supply.”

These return on investment figures compare favourably with Croydon council’s published returns from their existing investments: 3 year annualised return 6.5%, 5 year annualised return 7.9%. (Croydon Pension Fund Annual Report 2023/24 published March 2025).

It should be mentioned currently Croydon council has a small investment in housing of less than 11% of its pension pot, which has been reduced in the last year whilst investments in arms have increased. A lot more investment in social housing is needed.

There are lots of housing funds for the council to invest in, many include options for that investment to be used to build affordable housing in the locality of the investing council:

Legal & General (L&G) Affordable Housing Fund

In 2023, L&G Affordable Homes built 1,304 homes. Greater Manchester Pension Fund in July 2024 invested £120 million. This January, it increased its investment by an additional £100 million to be used to build affordable housing in the Manchester area.

Octopus Affordable Housing Fund

They are on target to build 1,000 homes by the end of 2025.

Devon’s local government pension scheme invested £40m in Octopus affordable housing fund in July 2024 and by Christmas Octopus completed its first homes in Devon. By March 2025, the first 44 properties have already been built, accommodating a total of 154 residents in Devon.

A similar investment by Avon Pension Fund of £50 million will translate to 250 homes, housing up to 1,000 people. In comparison Croydon Council only built 17 homes last year and 12 the year before that.

LCIV UK Housing Fund

Launched in March 2023, it has already has attracted £530m investment from 9 London councils. The government is pushing London councils to pool its pension funds in LCIV, this would be a good choice to achieve that requirement.

Its time for Croydon council to invest in homes for Croydon, rather than arms for genocide in Palestine.

Reason Two – Cost of Divestment

The second reason give by the pension committee as to why the council cannot divest is that divesting from individual companies or sectors will “incur significant costs”.

Inevitably any changes in the investment portfolio will incur costs as assets in one company or a pool of companies will have to be sold and assets in another company or a pool of companies will have to be bought with commissions paid along the way. But are they really exorbitantly high to dissuade divestment?

We will look at the example of Islington Council that last year took the step to divest its investments from companies listed by the UN as “compliant in human rights abuses” in Palestine. They have a report on the restructuring of their pension fund for divestment*, which includes costings and other considerations.

It shows the guilty companies are in two Legal & General managed passive equity investment pooled funds.

Each fund follows a different tracker index, and charges a different management commission:

- MSCI Low Carbon: , £220m invested, management cost 6.76 basis Points (149k pa)

- Paris Aligned World Equity Index: £183m invested, management cost 8 basis points, (146k pa).

- Total management cost £295k pa

The Fund’s investment manager, LGIM, has recommended that the simplest and cheapest way of divesting would be to create a new single custom pooled fund especially for Islington council that combines both portfolios into one. This would enable the Fund to customise its benchmark, and also give the fund the flexibility to make other custom alterations in the future should there be a requirement.

The new fund will continue to follow one of the existing trackers ( Paris Aligned World Equity Index ) and will be managed by l&g incurring the same 8 basis points commission cost (£322 pa).

Because previously, one of the two funds had a lower management commission cost (6.76 basis points) the new custom fund will cost slightly more – an extra £27k pa.

There will also be a one-off transition cost of £539k. The report states that “The investment transition costs of 0.03% of total fund value is not considered to be financially detrimental to the fund” (The Islington pension fund was valued at £1.8 billion at the time).

- Custom fund, Paris Aligned World Equity Index: £403m invested, cost 8 basis points, (322k pa).

- One-off transition cost £539k

Our analysis shows that 99% of Croydons investments in arms companies are in a single fund managed by L&G (L&G FTSE world ex tobacco fund) so the costings outlined in the Islington report are directly relevant to Croydon. Though there shouldn’t be any increase in commission costs as the guilty companies are all in one fund following one tracker index, so no extras to pay per annum – only the one off transition cost to pay which is 0.03% of the total fund value. The Croydon pension fund is valued at £1.96 billion (31 March 2025), so the estimated cost of divestment is £588k.

Cost of Croydon divesting from L&G FTSE world ex tobacco fund, and creating custom L&G fund excluding arms companies, following existing tracker:

- No change in fund management cost (as following same tracker)

- One off transition free £588k (0.03% of total fund value of £1.96 billion)

The proposed solution by L&G has built in flexibility to allow divestment in tactical stages with minimal costs. So it would be possible, for example, to initially divest from only arms companies thus attracting no controversy, and then at a later stage from all companies complicit in the occupation. Most importantly the Islington case study shows that divestment would not be “financially detrimental to the fund”.

*https://islington.moderngov.co.uk/documents/s38207/Passive%20Equity%20Portfolio%20Restructuring%20Update.pdf

Support Of Pension Scheme Members

Apart from financial considerations the Islington report does states there is a second component to meeting fiduciary responsibility: “The Council’s fiduciary duties will be met if it can demonstrate good reason to think that scheme members would share this concern”.

In Croydon there is strong support for divestment among council workers who contribute to the pension scheme as demonstrated by the support of their unions.

Unison is the largest of the three local government unions (others are GMB and Unite) and represents a significant number of Croydon LGPS members. Many of whom have already written to the pension committee expressing that they are appalled to find out where their pension is being invested.

Last month Croydon UNISON passed a motion in support of divestment. They are committed to supporting members to demand divestment.

One of the other local government unions, Unite, had a strong presence at the protest outside the town hall last month demanding the council divest. Their retired members section in particular were very vocal.

Croydon Trade Union Congress also passed a motion in July 2025 in support of divestment. It read:

“Croydon TUC supports the aims of the Croydon Divest campaign. We also ask the Council to note that the national policy of all 3 of the largest unions for Croydon Council employees (Unison, GMB and Unite) is in favour of the BDS (Boycott, Divestment and Sanctions) movement.”

Engagement

Another common response by councils to calls for divestment is to suggest constructive engagement with the companies. To leverage their investments to get companies to change their behaviour. The Local Authority Pension Fund Forum (LAPFF) is the body used for this.

The LAPFF is a collaborative organisation that represents the interests of local authority pension funds. LAPFF focuses on environmental, social, and governance (ESG) issues, advocating for sustainable business practices among the companies in which its members invest. Whilst LAPFF claims some success over the years regarding environmental issues, it has had no success when it comes to Israel.

In Feb 2019 LAPFF started its engagement with TripAdvisor and Booking.com to remove its listings in illegal settlements, emphasising the ethical implications of profiting from illegal activities. Six years of engagement has bore no fruits – both companies still flaunt international law by their complicity in promoting illegal settlements.

In March 2019 LAPFF started engagement with Elbit, again with no success. Tired of waiting, East Sussex Pension Fund that had worked with LAPFF, divested from Elbit in 2021. Six years of engagement has just emboldened Elbit and today its more entrenched in genocide and war crimes than it has ever been, selling its weapons as having been battle tested on Palestinians. Engagement has been proven not to work, its just buys guilty companies time.

The Cost Of Not Divesting

Something council pension committee members seldom think about is the cost of not divesting. They assume there is no cost for the council, the pension committee and certainly not themselves. But with a genocide happening in front of our eyes this is not the case.

In June 2024, the United Nations Human Rights Council’s warned financial institutions, including pension funds, that investment in companies providing Israel with weapons or military technology could lead to “repercussions for complicity in potential atrocity crimes”.

‘Atrocity crimes’ refer to the three legally defined international crimes of genocide, war crimes, and crimes against humanity.

Last month a report published by the United Nations Human Rights Council specifically accuse’s pension funds as “enablers” of the genocide in Gaza.

But it doesn’t stop there, it goes on to warn that “important precedents exist. The post Holocaust industrialists’ trials, such as the I.G. Farben trial, laid the groundwork for recognizing the international criminal responsibility of corporate executives for participation in international crimes.” This includes financial institutions like pension funds for their participation in enabling war crimes. Its instructive that individuals in positions of decision making in these institutions were personally held accountable for culpability in genocide.

Croydon council needs to understand this isn’t something they can sweep under the carpet hoping it will go away.

They have a choice of leaving a legacy of caring for their community by choosing to invest in social housing or a legacy of one day standing in the Hague with Netanyahu, charged with complicity in ‘atrocity crimes’.

Other Interesting Posts:

“I Don’t Have Bombs Raining Down”

“I Don’t Have Bombs Raining Down”

Lockheed Martin’s Dirty Secret

Lockheed Martin’s Dirty Secret

Croydon Demands Council Divest From Genocide

Croydon Demands Council Divest From Genocide

Croydon Divest – Protest Pension Committee Head

Croydon Divest – Protest Pension Committee Head

Protest Croydon Labour Party Fundraiser

Protest Croydon Labour Party Fundraiser

1,000 Divestment Letters Target Smashed!

1,000 Divestment Letters Target Smashed!

Help Send 1000 Letters – Croydon Council Divest From Genocide

Help Send 1000 Letters – Croydon Council Divest From Genocide

Write To Your Councillor – Divest From Genocide

Write To Your Councillor – Divest From Genocide

Croydon Divest Coalition Challenges Council Over Genocide Investment

Croydon Divest Coalition Challenges Council Over Genocide Investment

Croydon Divest – Letter To Council

Croydon Divest – Letter To Council

We Demand Croydon Council Divest From Genocide

We Demand Croydon Council Divest From Genocide

Perverted Judicial System – #Filton10 Unjustly Imprisoned 81 Days

Perverted Judicial System – #Filton10 Unjustly Imprisoned 81 Days